Understand Your Credit Score

What Is A Credit Score?

A credit score is a three-digit numerical representation of an individual's creditworthiness and is used by lenders to assess the risk of lending money to them. TransUnion and Equifax are the two major credit reporting agencies in Canada that calculate and report your credit score between on a rage between 300 – 900 (higher the score, the better).

Image by pch.vector on FreepikWhy Is Your Credit Score Important?

A good credit score is crucial if you ever want to obtain a loan - especially at favourable rates. If you’re thinking of buying a house you’re more than likely going to need a mortgage, so making sure your credit is in good standing is critical to a smooth and successful purchase. Here are a few additional reasons why strong credit is important:

Lending Decisions: Lenders, such as banks or credit card companies, use your credit score to determine whether to approve your loan applications and what interest rates to offer.

Access to Credit: A higher credit score can provide access to better credit options, including lower interest rates, higher credit limits, and more favorable loan terms.

Rental Applications: Landlords often check credit scores to evaluate prospective tenants' financial responsibility and ability to pay rent on time.

Insurance Premiums: Some insurance providers consider credit scores when determining premiums for auto or home insurance.

Why You Should Know Your Credit Score?

Financial Awareness: Understanding your credit score helps you gauge your financial health and gives insight into how potential lenders may perceive you.

Identifying Errors: Reviewing your credit report and score regularly allows you to identify any errors or discrepancies that could negatively impact your creditworthiness.

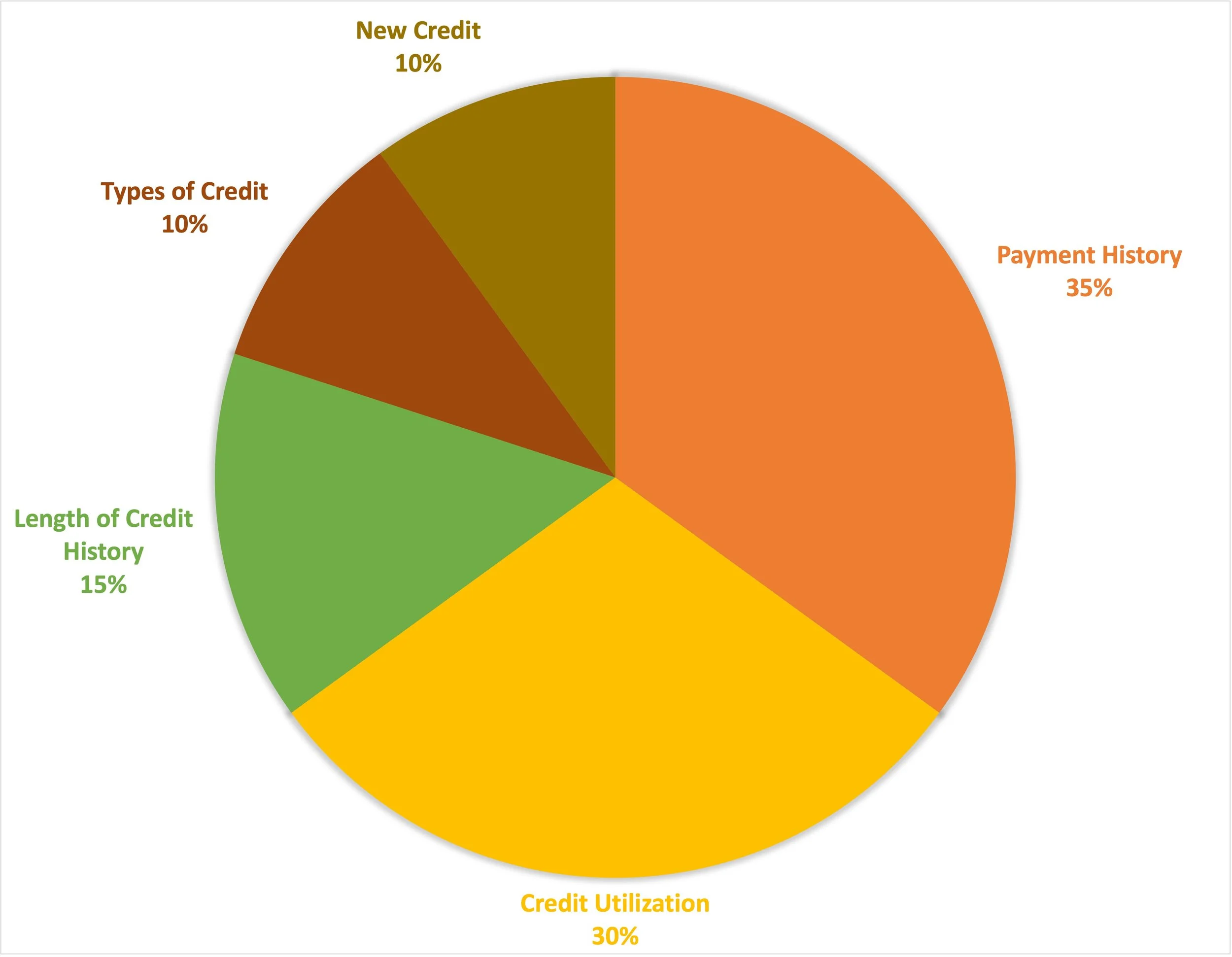

What Contributes To Your Credit Score?

Payment History – 35%: This is most important aspect of your credit score because it shows lenders whether or not you pay your bills on time and in full.

Credit Utilization – 30%: The amount of credit you have on our accounts relative to what you’ve been approved for shows lenders that you may not have control of your debt or are over extending yourself. It’s often recommended to keep utilization below 30%. For example if you have been approved for $1,000 in credit, try not to use more than $300 for any reporting period.

Length of Credit History – 15%: Aside from your payment history, the average length each credit account was open for also plays an impact in your credit score. Yes, closing an account, even if you don’t use it, can negatively impact your credit score, especially if it’s an older account.

Types of Credit – 10%: Diversity of credit also positively adds to your credit score – revolving lines of credit (credit cards, HELOCs), installment loans (mortgages, student loans), etc.

New Credit – 10%: Every time you apply for credit, an “hard pull” (inquiry) of your credit report will be made and will appear on your account. Multiple hard pulls in a short period of time will negatively impact your credit score.

How Can You Improve Your Credit Score?

Now that you know what makes up your credit score, it is clear what steps can be taken to improve your score:

Pay Bills on Time: Consistently paying your bills, loans, and credit card balances on time is crucial for building a positive payment history, which is a major factor in credit scoring.

Reduce Credit Utilization: Aim to keep your credit balances low (no higher than 30%) compared to your available credit limit. High credit utilization can negatively affect your score.

Minimize New Credit Applications: Multiple credit applications within a short period can be seen as a sign of financial instability. Apply for credit only when necessary.

Maintain a Diverse Credit Mix: Having a mix of different credit types (e.g., credit cards, loans, mortgage) and managing them responsibly can positively impact your score.

Regularly Check Credit Reports: Monitor your credit reports for errors or fraudulent activity, and promptly dispute any inaccuracies you find.

What Is A Good Credit Score

300 to 559: Very poor

560 to 659: Fair

660 to 724: Good

725 to 759: Very good

760+: Excellent

How To Check Your Credit Score?

Equifax and TransUnion: You can receive a copy of your credit report directly from Equifax or TransUnion once a year if you order it via email them 2 pieces of ID. While your credit report will show your credit history and credit accounts, it won’t show your credit score. In order to see your credit score, you will need to pay a fee.

Borrowell: You can use Borrowell to get your Equifax credit score. Borrowell is an online app that shows users their credit score, credit accounts, credit history, as well as makes recommendations on how to improve your score. (for disclosure, the company makes money by offering credit products from various intuitions, if you sign up, Borrowell will earn a fee).

Credit Karma: You can use Credit Karma to get your TransUnion credit score. Credit Karma’s operating model is very similar to Borrowell - it is an online app that shows users their credit score, credit accounts, credit history, as well as makes recommendations on how to improve your score – they also earn a fee if you sign up to one of the products they promote in the app.